Ways to Give

One-time gift

Any gift – large or small – is important. By donating to Brain Canada, you are supporting some of Canada’s boldest explorers and driving brain research forward.

Monthly gift

Give your gift its full potential by joining The Great Minds, Brain Canada’s circle of monthly donors. An automatic pre-authorized payment will be charged to your credit card each month.

Give in memory or in honour of someone

This type of gift is a meaningful way to honour a loved one and show them you care. It can be for a special occasion (birthday, anniversary or holiday) or just to continue showing your support.

Donate securities

A gift of appreciated securities can mean greater tax savings for the donor than an equivalent gift of cash. The process is simple; your financial advisor transfers the securities from your account to a Brain Canada brokerage. Donors are eligible for a tax receipt for the fair market value of the securities at market close on the date of transfer.

Build your legacy with Brain Canada

Planned Giving

A legacy gift is a demonstration of your belief in the continuity of the charities that you care about and want to support for generations to come. It is a way to leave a lasting mark by supporting the charity of your choice. Regardless of age or wealth, all of us have the ability to leave a legacy.

How it works

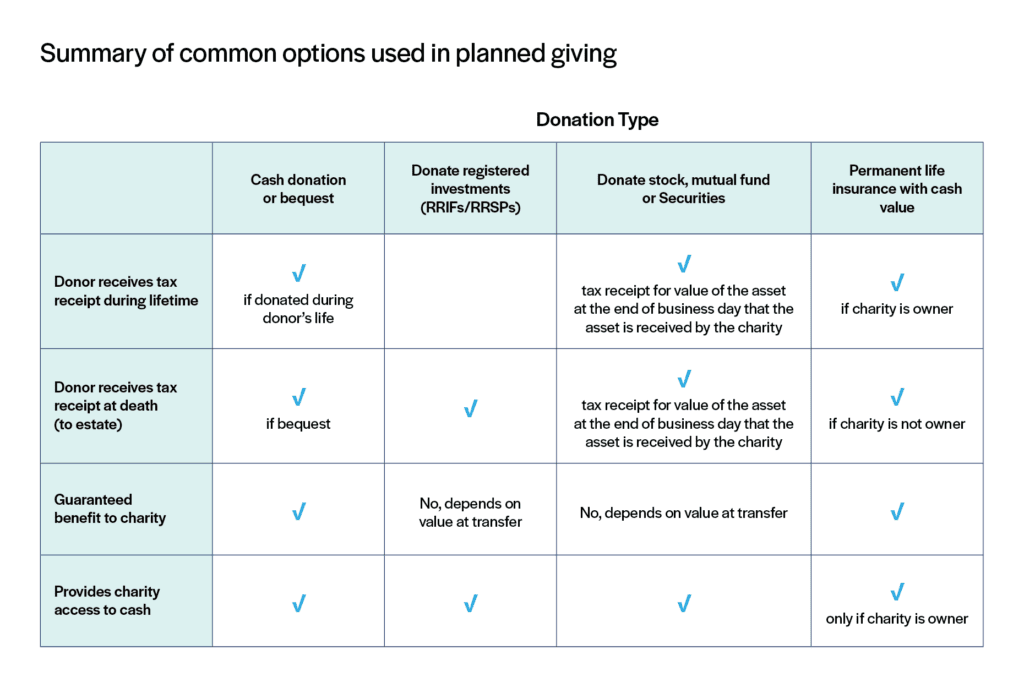

There are several options available to make a legacy gift. The legacy gift can be structured to fit your family and financial objectives.

Some planned giving strategies are:

- Bequest in a will

- Gift of assets

- Gift of life insurance

- Donor-advised funds

Learn more about legacy gifts and to determine how to make the most meaningful legacy gift for you.

Corporate partnerships

There are many ways employers and their teams can support Brain Canada. Corporate donations, employee donation matches, employee giving programs or workplace fundraisers are all trusted giving options for corporations.